Exploration, Development and Abandonment

Exploration, Development and Abandonment

Before drilling an exploration well an oil company will have to obtain a production licence. Prior to applying for a production licence however the exploration geologists will conduct a ‘ scouting’ exercise in which they will analyse any seismic data they have acquired, analyse the regional geology of the area and finally take into account any available information on nearby producing fields or well tests performed in the vicinity of the prospect they are considering. The explorationists in the company will also consider the exploration and development costs, the oil price and tax regimes in order to establish whether, if a discovery were made, it would be worth developing.

If the prospect is considered worth exploring further the company will try to acquire a production licence and continue exploring the field. This licence will allow the company to drill exploration wells in the area of interest. It will in fact commit the company to drill one or more wells in the area. The licence may be acquired by an oil company directly from the government, during the licence rounds are announced, or at any other time by farming-into an existing licence. A farm-in involves the company taking over all or part of a licence either: by paying a sum of money to the licencee; by drilling the committed wells on behalf of the licencee, at its own expense; or by acquiring the company who owns the licence.

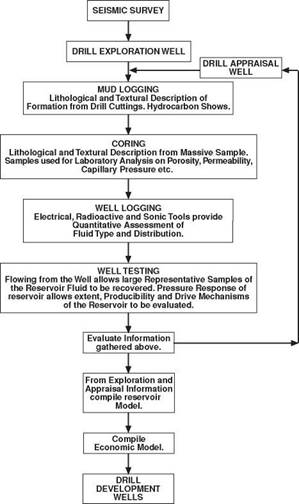

Before the exploration wells are drilled the licencee may shoot extra seismic lines, in a closer grid pattern than it had done previously. This will provide more detailed information about the prospect and will assist in the definition of an optimum drilling target. Despite improvements in seismic techniques the only way of confirming the presence of hydrocarbons is to drill an exploration well. Drilling is very expensive, and if hydrocarbons are not found there is no return on the investment, although valuable geological information may be obtained. With only limited information available a large risk is involved. Having decided to go ahead and drill an exploration well proposal is prepared. The objectives of this well will be:

To determine the presence of hydrocarbons To provide geological data (cores, logs) for evaluation

|

X |

To flow test the well to determine its production potential, and obtain fluid samples.

The life of an oil or gas field can be sub-divided into the following phases:

• Exploration

• Appraisal

• Development

• Maintenance

• Abandonment

|

Figure 1 Role of drilling in field development |

The length of the exploration phase will depend on the success or otherwise of the exploration wells. There may be a single exploration well or many exploration wells drilled on a prospect. If an economically attractive discovery is made on the prospect then the company enters the Appraisal phase of the life of the field. During this phase more seismic lines may be shot and more wells will be drilled to establish the lateral and vertical extent of (to delineate) the reservoir. These appraisal wells will yield further information, on the basis of which future plans will be based. The information provided by the appraisal wells will be combined with all of the previously collected data and engineers will investigate the most cost effective manner in which to develop the field. If the prospect is deemed to be economically attractive a Field Development Plan will be submitted for approval to the Secretary of State for Energy. It must be noted that the oil company is only a licencee and that the oilfield is the property of the state. The state must therefore approve any plans for development of the field. If approval for the development is received then the company will commence drilling Development wells and constructing the production facilities according to the Development Plan. Once the field is ‘on-stream’ the companies’ commitment continues in the form of maintenance of both the wells and all of the production facilities.

After many years of production it may be found that the field is yielding more or possibly less hydrocarbons than initially anticipated at the Development Planning stage and the company may undertake further appraisal and subsequent drilling in the field.

At some point in the life of the field the costs of production will exceed the revenue from the field and the field will be abandoned. All of the wells will be plugged and the surface facilities will have to be removed in a safe and environmentally acceptable fashion.